Pay Frequency versus Filing Frequency

Understanding the difference between a Pay Frequency and Filing Frequency and what you need to do going forward.

DIFFERENCES BETWEEN PAY AND FILING FREQUENCIES

Pay frequencies and filing frequencies are related, but it's important to understand the difference between the two. Using an incorrect pay frequency can result in tax notices, penalties and interest that you would owe to a tax agency.

-

Pay Frequency refers to how frequently tax liability is remitted to a tax jurisdiction.

-

Filing Frequency refers to when an agency expects to receive a tax return.

If a pay frequency isn’t provided by an agency, the best course of action is to use the most aggressive option unitl you can confirm the desired frequency. It is critical to obtain the correct pay frequency that has been assigned by the taxing jurisdiction to ensure your payments are received on time.

There are several states that have a return requirement that is based on the pay frequency. The best example of one of these states is Massachusetts.

-

Pay Frequency = Semi-Weekly - a quarterly tax return is expected

-

Pay Frequency = Monthly - a monthly tax return and annual reconciliation is expected

-

Pay Frequency = Quarterly - a quarterly tax return is expected

Using this example - if your pay frequency is set to semi-weekly but you are assigned a monthly pay frequency, you will receive a tax notice from Massachusetts because the return they expect is not being filed.

UPDATING A PAY FREQUENCY

Follow these steps to update a pay frequency in Namely Payroll for the current year.

Example: the frequency notice you have is for tax year 2020 and today’s date is after 1/1/2020.

-

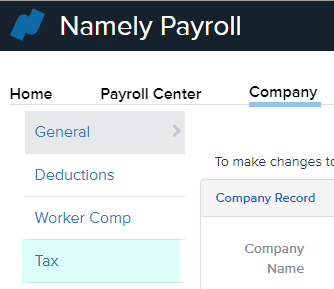

Log into Namely Payroll.

-

Go to the Tax table from the Company tab:

-

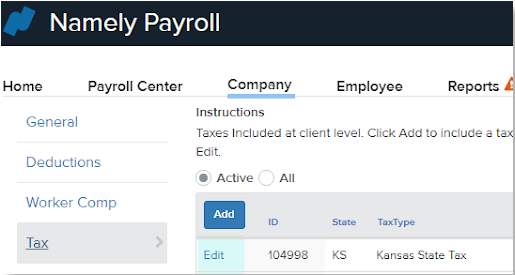

Go to the appropriate tax code. Then, click Edit:

-

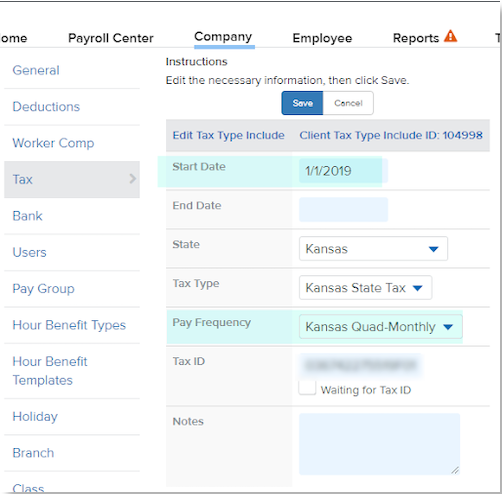

Update the Pay Frequency field as necessary.

-

Click Save.